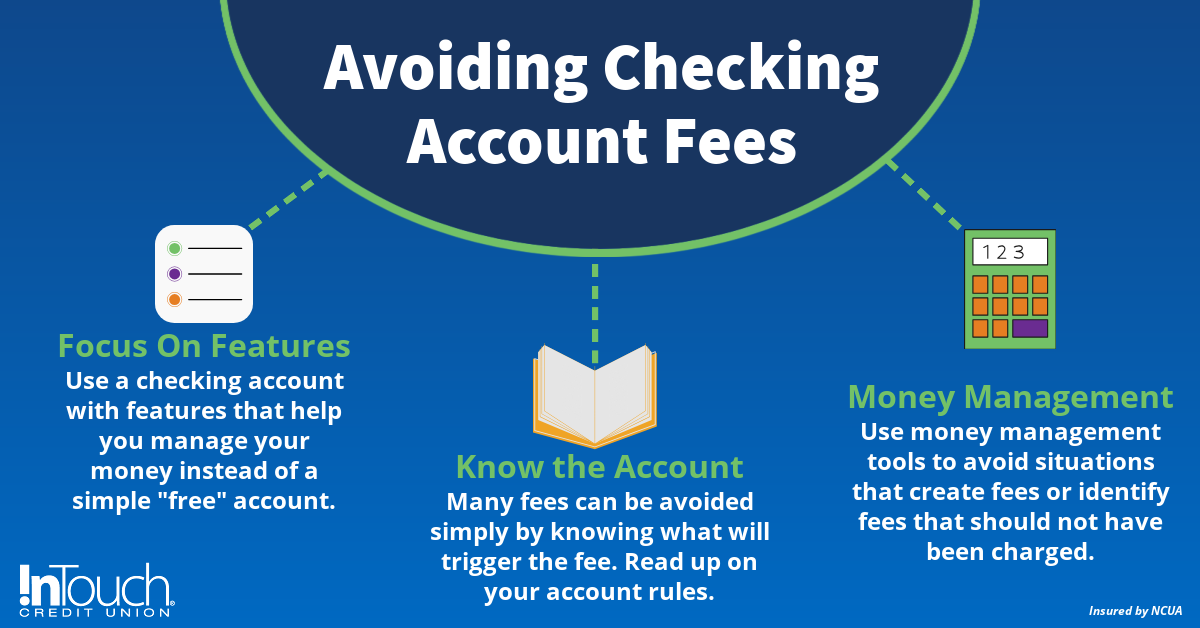

No one wants to lose hard-earned money to fees. While it may be possible to find a bank with no fees, avoiding checking fees can often be as simple as choosing the right account for your financial lifestyle, and adopting money management habits that protect you from activities that trigger fees.

Choosing an Account with Features You Will Use

Whether you use paper checks or a debit card, a checking account is the standard spending account for most adults. At first glance, a checking account that advertises having “no fees” sounds great. However, “no fees” usually refers to the absence of monthly account maintenance, and most banks and credit unions offer at least one no-monthly-fee option.

Keep in mind that a checking account with no maintenance fees is often not completely free. Usually, some transactions or services will not be free even with a “no fees” account. You may be charged for receiving paper statements, stopping payment of checks, or ordering paper checks. So be mindful of the many ways that you may use your account to keep your fees in check. If you regularly use services that incur a fee, you may save money by using a “premium” checking account that provides the services you frequently use for free.

Avoiding Checking Account Fees Can Be as Simple as Understanding Them

One of the most common fees is the NSF fee, or non-sufficient funds fee. This is the long term for a check bouncing back. When a check is returned for NSF, you could find yourself on the hook for vastly more than the check was written for, as both the merchant and the bank assess a charge to you. Recently, however, we are seeing more financial institutions offering “No NSF” checking accounts including InTouch Credit Union. But, depending on the bank, you may not be entirely off the hook! Some banks may charge a fee for transferring funds between accounts. It is important to know how your account is set up to handle such situations.

More Resources for Avoiding Fees

Knowledge is power, especially when it comes to avoiding checking account fees. Here are a few more resources to help you power up your checking account knowledge.

InTouch Credit Union's Checking Account Options

Each account comes with different benefits. Find one that fits your needs.

How to Open a Checking Account Online

After finding the right account for you, conveniently open an account online.

Avoiding Checking Account Fees with Money Management Skills

Of course, the best way to avoid fees like NSF is to not be caught in such a situation. If you want to really understand your spending habits and make sure you have a clear picture of how your money moves around, use a personal financial management program like InTouch’s Money Management tool. You can track spending, set budgets, and create alerts when your account balance drops below a set amount. Watch your statements for unexpected fees, as well, and be sure to contact the financial institution if an unexpected fee hits. Sometimes mistakes happen, but they may also signal it is time to change to a different account or how you manage your funds.

Your banking habits also affect the probability of finding a no fee account. Do you like to deposit your paychecks yourself? Most banks prefer you to use direct deposit because it reduces paperwork, and some even charge if you do not set up direct deposit. If you tend to deposit checks regularly, check what triggers fees.

Do you maintain a certain balance in your account? The fee structure of many accounts depends on you holding a specific balance. Dip below that balance, and your account may incur fees until you bring it back up. Are you a regular user of ATMs? Check to see if the number of ATM transactions or the specific locations/networks are limited.

Take charge of your finances with a clear picture of what actions may incur a charge. InTouch Credit Union provides a handy table that allows you to compare accounts to find the one with features that appeal most to you or works best with the way you handle your money. If you have questions about which account is right for you, please contact us.