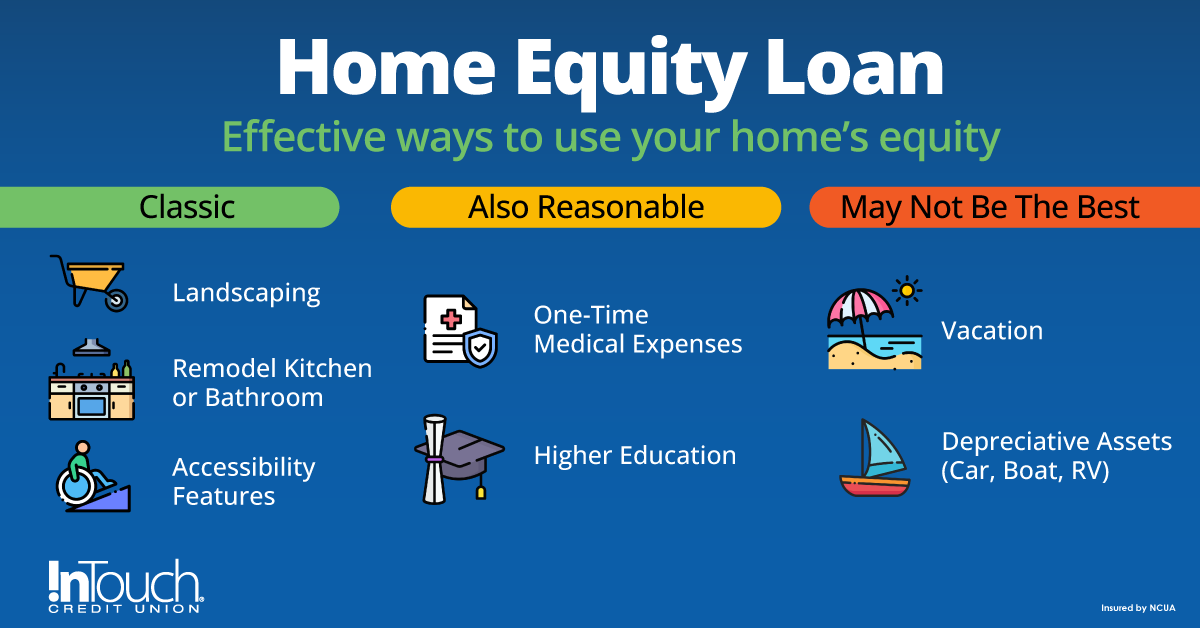

Home equity loans are often advertised as an enticing solution to pay for anything from vacations to education to home improvements. However, which of these make the most sense to spend your hard-earned home equity on? Prior to accessing your home’s equity, take some time to assess your financial situation and priorities.

What is a Home Equity Loan?

Taking out a loan against your home’s equity effectively means opening a second mortgage. If you sell your home and you have not paid off the home equity loan, then the remaining loan balance will come out of the sale proceeds, along with the first mortgage balance.

One of the best and most popular uses for home equity loans is home improvements. Why? Beyond improving your home life, such projects can increase your property value. Anything from landscaping, building a bathroom, giving the kitchen a makeover, or even adding accessibility features, turns the equity you spend back into the home.

Build Equity by Using Equity

Beyond building equity, a home equity loan can serve other unexpectedly useful purposes, such as a one-time medical expense or investing in higher education. The crucial aspect of leveraging home equity loans for short-term needs is ensuring prompt repayment before the equity is required for other financial obligations.

Your home’s equity is calculated by considering how much you owe on your mortgage compared to the current appraised value of your home. While it is uncommon for the housing market to take a serious plunge, it is not unheard of. Analyze the current and forecasted health of the housing market to weigh the risks.

When a Home Equity Loan May Not Be the Best Idea

Some circumstances may not be suitable for a home equity loan. If you anticipate recurring debts or foresee significant upcoming expenses, tapping into your equity might not be advisable. It’s crucial to carefully evaluate your repayment capacity and whether using a home equity loan aligns with your long-term financial goals. Large depreciative assets like vehicle or RV purchases also are not ideal matches for home equity loans because your loan balance may surpass the asset’s value, also known as an “underwater” loan. In such cases, even the sale of your home may not cover the outstanding loan. A home with an existing line cannot be sold, so the remaining balance will have to be paid off or refinanced as a non-equity loan at a much higher rate.

By assessing your finances, goals and desired outcomes, you can avoid buyer’s remorse or potential financial pitfalls in the future. If you would like assistance in evaluating your financial situation, consider scheduling an appointment an appointment at your local InTouch Credit Union branch to explore your options.

Read On

Looking to learn more about home equity loans or even line of credit? Check out these other resources!