Budgets! Useful, maybe even necessary. So why do we avoid them? Budgeting can seem like more work in our complex lives. But what if we changed our mind set and thought of a budget like a house instead of a burden?

The Architecture of Your Best Budget

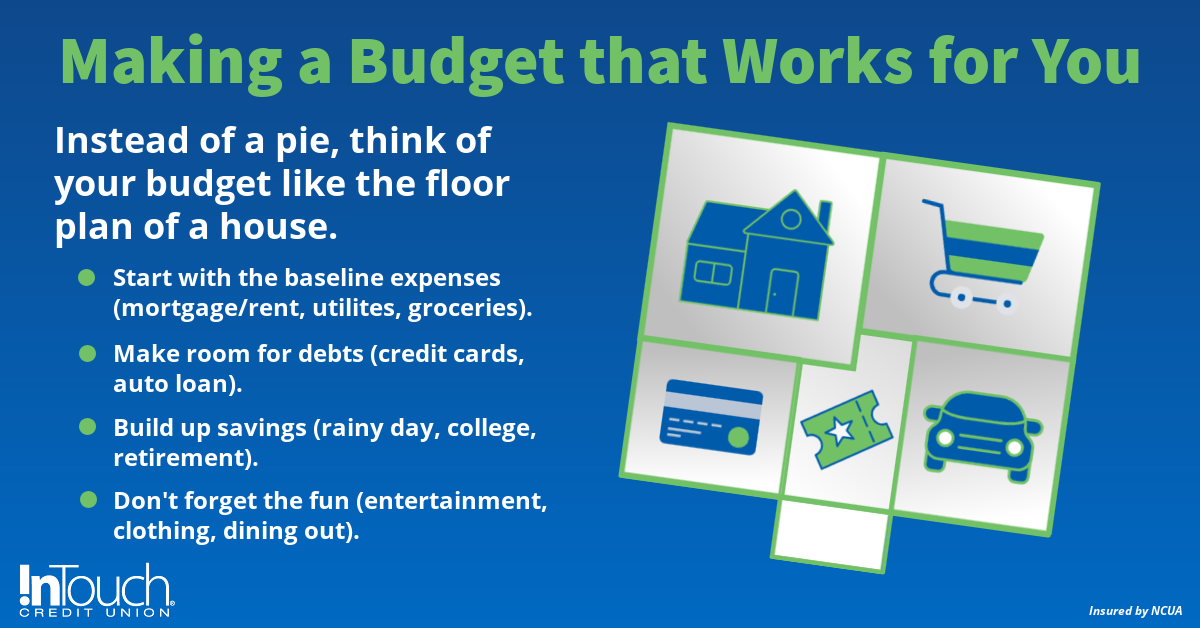

When you plan to build or buy a house, you need to decide whether your lifestyle is compatible. If you look at your fiscal life like a house, budgeting is like designing a home to reflect your lifestyle and priorities. In the same way that you would struggle with a large family in a small apartment, your spending and savings plans must be a good fit for your life. You can “move the walls” of your budget and find the arrangement that suits you.

Getting off to a Simple Start

Begin with four walls, add a door, and divide the space into distinct rooms, just like building a house. You will approach crafting your budget’s first draft the same way. Your monthly take-home pay represents the walls of your financial house. Add in your baseline monthly expenses like rent/mortgage, utilities, groceries, etc. Look at the debt and savings categories that are important to you such as student loans, credit cards, and retirement savings. Finally, consider the expenses that tend to fluctuate, but are mostly “wants,” like entertainment, clothing, and gifts.

This process may seem extensive, but the result is a functional framework. Similar to organizing a house, you’ve categorized your expenses and can start identifying areas of improvement. For added convenience, InTouch Credit Union offers Money Management, a personal financial management (PFM) tool for members to simplify budget setting and tracking.

Choosing a Budgeting Framework

There are many budgeting frameworks or “house plans”, but finding the right one will take experimentation. Two popular options are 50-30-20, and 70-20-10. In the former, 50% covers necessities, 30% is allocated to wants, and 20% for loan repayment and savings. In the latter, 70% is for necessities, 20% is for loan repayment and savings, and the remaining 10% for wants.

| Plan | 50-30-20 | 70-20-10 |

| Necessities | 50% | 70% |

| Savings/Loan Repayment | 30% | 20% |

| Wants | 20% | 10% |

Once you begin to view your expenses through a budgeting lens, compare your current spending against these guidelines. Utilizing Money Management allows you to easily track your progress in each category. Do your spending percentages align with one of these models? Are you comfortable with your financial situation in this “house”? Additionally, explore the Financial Calculators available on ITCU's website for further insights. Our dedicated team is also ready to assist you.

Check For Fit and Comfort

Just as your home reflects your unique comfort zone, your financial well-being requires upkeep. Assess your budget every six months for a comfortable fit. Embrace flexibility when reallocating funds to meet lifestyle changes or new goals as they arise. Approaching budgeting as a means to build a healthier financial life, not a "money prison," makes it more manageable.