Is Free Checking Really Free? How to Make Sure You Are Getting a Good Value

Checking accounts are still a thing. While most of us write fewer checks than ever, and some write none, a considerable amount of banking still takes place through checking accounts, with ATMs and debit card transactions now doing the bulk of the work. If you are one of the millions not writing a lot of checks, you may have been tempted to consider a free checking account to reduce expenses. But take a moment to consider the terms and conditions that can make it hard for any account to be completely free.

Some Details to Look Out For

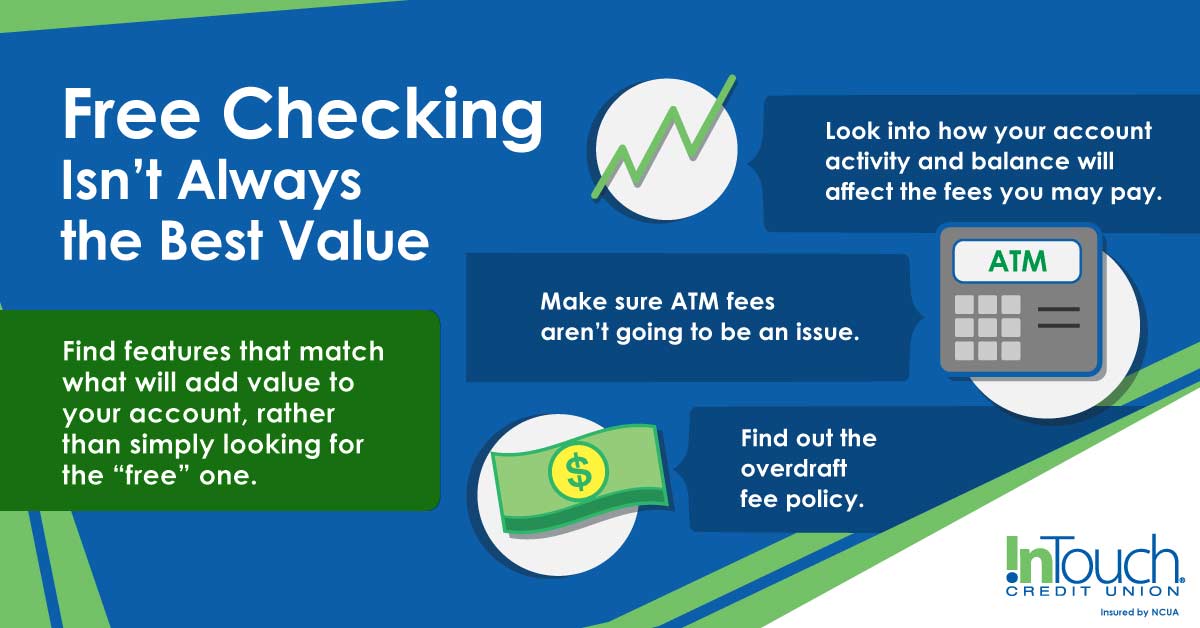

Although banking disclosures can be dozens of pages long, there are a few common traits of checking accounts that can give you a fair picture of how the institution’s fees are likely to affect you. To begin, look for an institution that tries to help you to understand the variety of costs and benefits associated with each of their financial products. A comparison chart, like the one on InTouch Credit Union’s Choose Your Checking Account page, can help you to see how your account activity and balance will affect the fees you may pay.

The two features that have traditionally defined free checking are the lack of monthly service fees and free checks (usually with a limit of one or two free boxes a year). You can still find accounts with these features, but there are a lot more options that might influence the value you get from your account.

The way you maintain your account is potentially one of the greatest impacts on the fees and benefits you can expect. For example, if you keep a higher balance (at least over $1,000 but often $5,000, or more), then you will almost always qualify for an

account with extra benefits. However, even high balance accounts are not always fee-free, as there is usually a low-balance fee for going below the minimum balance.

More Resources for Choosing a Checking Account

Knowledge is power, especially when it comes to finding the right checking account. Here are a few more resources to help you power up your checking account knowledge.

InTouch Credit Union's Checking Account Options

Each account comes with different benefits. Find one that fits your needs.

How to Avoid Checking Account Fees

Avoiding checking fees can be as simple as combining the right account and good financial habits.

Be Aware of Common Checking Fees, Even with a “Free” Account

ATMs are a common source of unexpected fees for many checking accountholders. Be sure that if you choose a free checking account that ATM fees aren’t going to be an issue. Since most accountholders use ATMs more than printed checks, this could pile up fast. ATMs may be fee-free within a network, but you may be charged for using ATMs outside the network. If ATMs are one of your main access points, look for an institution with ATMs in locations where you are likely to be wanting cash the most. Look also for an account that allows you some number of reimbursed or waived “foreign” ATM fees. Foreign fees, also known as “surcharge fees,” are charged by the owner of the ATM. These are separate from your financial institution. In some cases, your financial institution may also belong to a surcharge-free network of ATMs. These ATMs usually may be found via a locator tool provided by your financial institution.

Probably the hardest fees to anticipate, and yet the hardest hitting, are the overdraft fees. Many institutions run all debits on an account first, then process credits. Because transactions are often processed in a batch, that could mean many transactions “fail” before your deposit is credited. That makes you vulnerable to multiple overdraft fees unless you can plan your transactions very carefully. Overdraft fees are often charged repeatedly, as well, with repeated attempts to clear a transaction accumulating a new fee with every attempt.

Be sure that you can set a “low balance alert” on any checking account you consider. That way, you may be able to avoid having to overdraft. Also, be sure that you understand the terms of your financial institution’s overdraft protection. You might want your debit card to simply stop you from making a transaction if the funds are not sufficient. Doing so would stop that overdraft from occurring.

Some More Esoteric Checking Fees

There are some fees, such as branch use, that seem quite odd, but are becoming more common. As branch use becomes less a part of our banking habits, some institutions have begun charging for in-person banking for “free” checking accountholders. Fees are also popping up for each use of a paper check, rather than electronic transactions (debit card or ATM, not wire transfer, which always incurs fees).

The Best Checking Account Option Is Often the Best Value

The best road to take is always the one that goes where you want to end up. So, as you look for a checking account, consider the features that match what you feel and will make your account have extra value to you, rather than simply looking for the “free” one.

If you see yourself traveling, then perhaps you will want to consider the size of the free ATM network over strictly looking at the account’s monthly fee. If you are likely to be writing checks often, then an account with a paper transaction-friendly fee structure is the place for you.

Being able to make clear comparisons between account types and features can give you more confidence that you have the checking account that is right for you at the best price for the package of benefits.