Health Savings Accounts, or HSAs, offer a tax-advantaged option to save money for some medical needs and are often paired with high-deductible medical insurance plans. The chief attraction of these accounts lies in the expected tax savings and the ability

of HSAs to roll over from year to year without penalty. But HSAs are a bit more complex than they might first appear. There are some questions to ask before you open one.

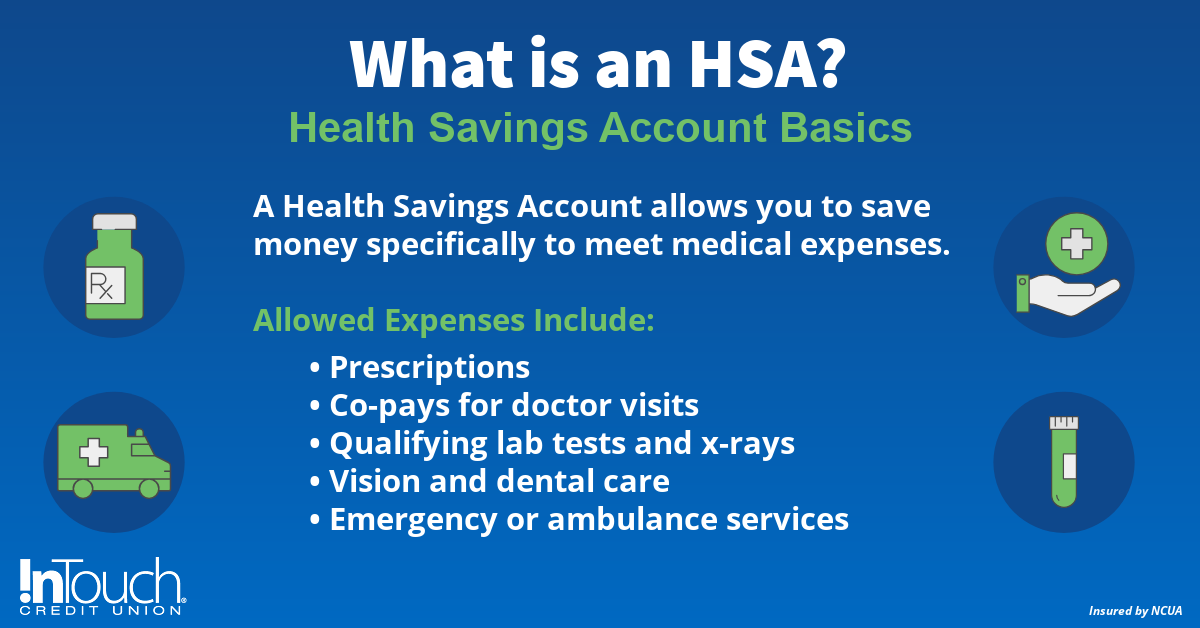

The Purpose of an HSA

A Health Savings Account is a savings account dedicated towards paying for medical expenses. The money is saved pre-tax (if your employer offers the option) or is eligible for tax deduction if you open the HSA at a financial institution. Unlike a regular

savings account, any interest earned in the HSA is also not taxed.

While the specifics may change year to year, the list of eligible medical expenses that you can spend your dedicated health savings funds on are typically:

- Prescriptions

- Co-pays for doctor visits

- Qualifying lab tests and x-rays

- Vision and dental care

- Emergency or ambulance services

Over-the-counter medications, reading glasses, vitamins, etc. are normally not eligible but always check the latest updates to see if new medical expenses may be covered. Many HSAs come with a debit card or checks that can be used for expenses, so you avoid the reimbursement process. This requires a special kind of care, though. Using the funds for unqualified expenses, even by accident, results in both taxation of the withdrawal and an assessed penalty. You cannot just repay the purchase made in error to resolve the issue.

ITCU Health Savings Account Option

InTouch Credit Union offers designated HSAs in both savings and checking formats.

Do I Qualify for an HSA?

Opening an HAS requires a qualifying, high-deductible health insurance policy. The next question is whether such a policy is right for you. High-deductible health

plans (HDHPs) might work well if preventive care is planned, limited, and minor. However, chronic conditions and the likelihood of needing major medical interventions could make HDHPs less attractive because out-of-pocket costs and co-pays are often

high, and the payment amount (up to the plan’s maximum deductible) for major medical expenses can be harder to manage than the higher monthly premiums of a lower deductible plan.

Above all, gather as much information about what your health plan covers (and at what rate), and what the allowable expenses within an HSA are. If these align with your household’s spending and saving habits, then you might find that the tax advantages

are enough of a draw to keep you interested.

A Different Kind of HSA

Since funds left in HSAs at the end of the year can be rolled over to the following year, it is possible to keep your HSA contributions in a specially designated health savings IRA account. With an HSA IRA, when your age exceeds 55, you are eligible to

contribute an additional $1,000 per year to your health savings, until you enroll in Medicare. Over time, if you remain in good health, it may be possible to accumulate a substantial amount geared towards your future medical needs.

Probably the best way to decide whether an HSA is right for you or your family is to speak with your financial advisor and to carefully consider your age and typical annual medical needs. If the potential lower premiums and potential tax benefits outweigh the potential outlay in higher deductible, then an HSA might be a sound investment for you.