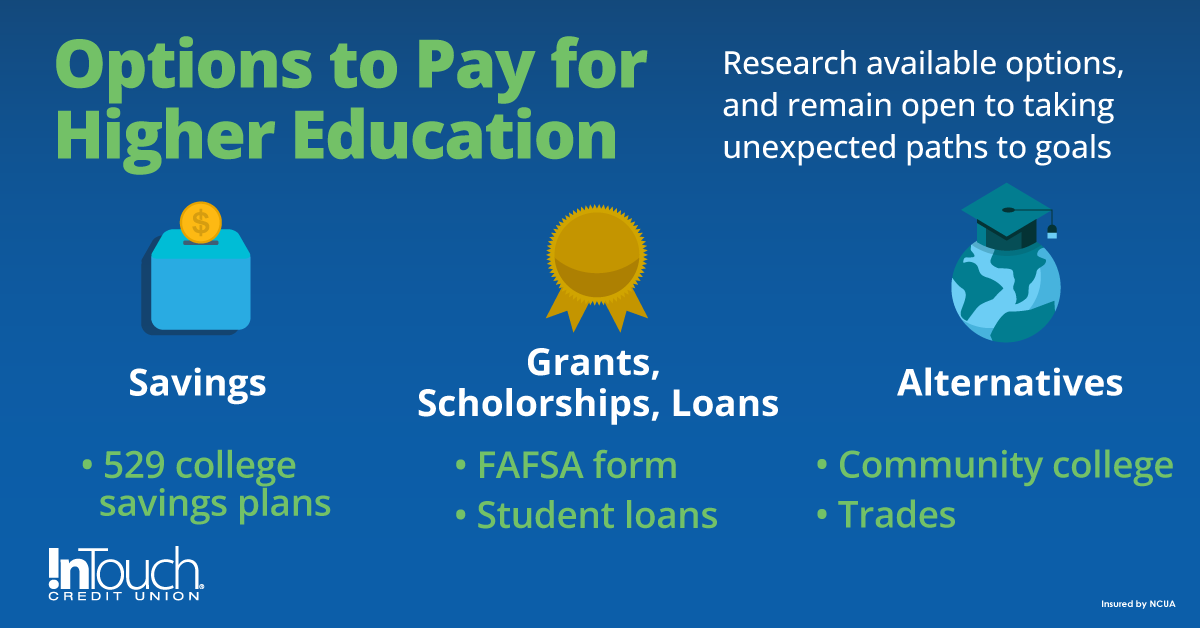

Throughout high school, students are pressured to choose advanced classes, join extracurricular activities, and contribute volunteer hours with the express purpose of getting into the best universities possible. However, what students and parents are rarely adequately prepared for is how to pay for higher education. With plenty of ways to fund higher education, choosing is made easier when you have a financing strategy in place to help your student reach their higher education goals.

Saving Up? Start Early!

Since the 1980s, the cost of college has risen at an alarming rate. In response, several states founded college savings accounts, commonly known as “529 college savings plans,” or 529 plans. These tax-exempt accounts allow families to invest money to pay for college or university fees. Like most savings accounts, the longest possible term of investing provides the best possible outcomes. Starting a 529 account when the child is born is the common admonition, but few families actually do this. So, if your focus was on diapers and not degrees all those years ago, what options make the most sense now if your child is already searching for their dream school and anticipating the delights of dorm food?

Grants, Scholarships, and Student Loans

All parents of high school students should fill out the Free Application for Federal Student Aid (FAFSA) form. While the amount of paperwork involved with college applications may feel overwhelming, this form should not be forgotten or ignored because it is the only way to qualify for income-based grants, scholarships, work-study qualifications, and federal student loans. Avoiding it means potentially leaving money on the table that could significantly ease the financial burden of paying for higher education. Most colleges and universities also will not consider students for institution-based scholarships without the FAFSA. You should thoroughly explore institution-based scholarships with the financial aid office of schools your student is interested in.

After you exhaust grants and scholarships, which are essentially “free money,” most parents and students turn to student loans. Over the past 40 years, the options for student loans have expanded, but not all of them specifically benefit students. You will want to explore the differences between federal and private student loans. Variations in fee structure, forgiveness opportunities and payment/collection processes for each loan could make a substantial difference on what your family can afford.

Understanding how much you can or should borrow will help you further clarify your choices. The first question is whether you can take on debt with a solid expectation of paying it off with your current income. Co-signing a loan places responsibility on the parents, whether the student completes college or not. Should the student have difficulty in a tough job market, the bill comes to the parents regardless. Will that be a reasonable or unreasonable option over the whole term of the loan’s life?

Alternatives to an Expensive University

When looking at federal student loans, the maximum borrowable amount is something to consider as well. With state universities often costing well over $10,000 per year and the maximum federal student loan amount coming in a few thousand dollars less than $60,000, on the surface, it looks quite possible. However, not all students will qualify for the maximum loan amount and joining the workforce with a bachelor's degree and $60,000 in debt plus interest can be quite the burden for a new graduate to carry, especially when there are rent, bills, food, etc. What are some alternatives to avoid that much debt?

One option is starting the college journey at a community college, which allows students to earn credits towards a degree while paying around half the cost of most universities. In recent years, there have been some real improvements in the cooperation between universities and community colleges. For example, in Texas and Michigan, students can participate in programs that help them choose community college courses that will transfer directly to a university. While each university differs in maximum transferrable credits, every bit helps. By taking a few semesters worth of applicable courses towards their desired major, students can save valuable money and time when they transfer.

An additional benefit of attending a community college is the opportunity to obtain an associate degree in a complementary field to their future university goals. For example, students looking to earn a business degree could first get an associate degree in business management practices. Earning such a useful credential not only supports their goal for a four-year college degree but also may assist in landing desirable internships. Gaining some experience in the industry will be a powerful booster for any resume and will definitely aid in landing a job upon graduation.

Finally, another path is to use the trades to pave the way. For example, a student who begins at a community college, earns a paralegal certificate, and then moves to pre-law can bump up their earning power to pay for their university studies. Complimentary courses and trades also give students the opportunity to earn some transferable credits while exploring a field to clarify their career options.

The Bottom Line

Choosing a way to pay for higher education can be as difficult as choosing a major. Researching available options and being open to taking nontraditional paths to reach your goals is a lot of work. However, it really is worth the time and effort to make sure that your student’s education and your future are on financially secure footing.

More Financial Resources

Learn More About Planning Your Financial Goals

Wish to plan your goals with a professional? Meet with a Financial Advisor.

Contact Us

Call, book an appointment, or submit a question. We will be happy to

be of assistance.

Visit a Branch

Find a location near you and see us in-person.