Our top estate planning tip is one of the easiest: designating beneficiaries for your financial accounts. Naming beneficiaries ensures they inherit your assets, and the legal importance of this cannot be understated. Documents should be reviewed regularly, especially as circumstances change like marriage, birth, death or divorce. While each state has specific rules for the process of legally settling an estate, also known as probate, bank accounts that are jointly owned or have designated beneficiaries usually do not have to go through this process.

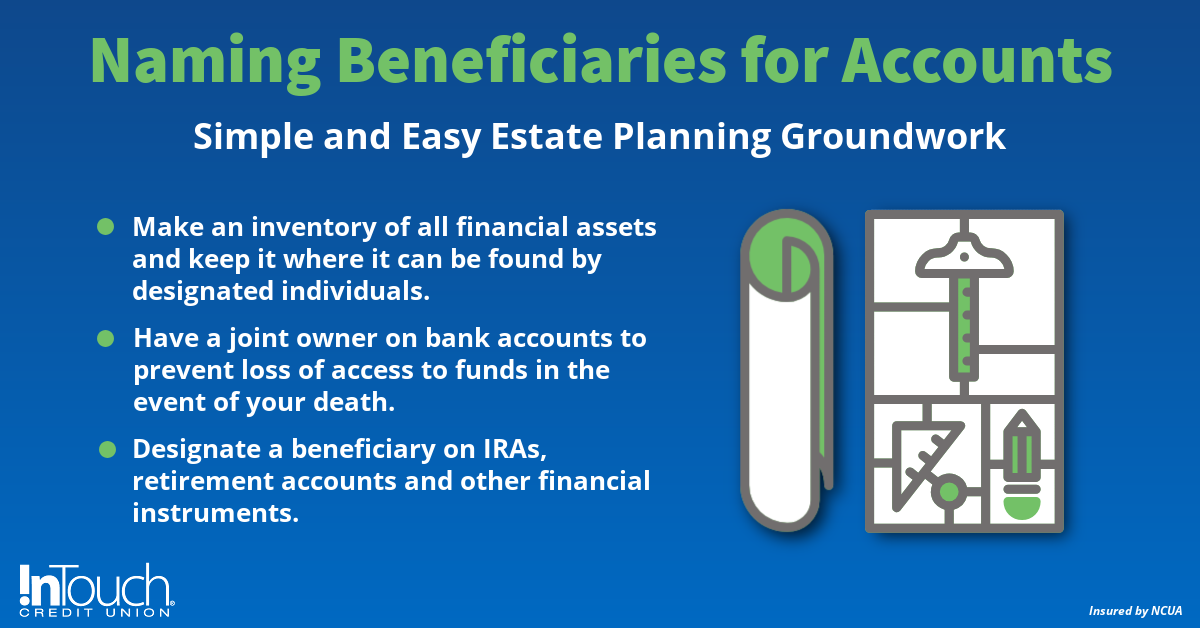

Laying the Estate Planning Groundwork

In the event you cannot manage your account, the joint account owner can pay bills without delay. The other benefit of having a joint owner is in the event of a co-owner’s death, the funds become the sole property of the co-owner of the account.

The other way to transfer your account holdings is to designate a beneficiary, usually in a form similar to “payable upon death.” This means that, upon providing a death certificate, your beneficiary receives the funds without probate or other

legal action. Investment accounts often have a “transfer upon death” option, moving the account or investment to the named beneficiary or beneficiaries.

Ask about the available options for every account you have, whether it is a savings, share certificate of deposit, IRA, or any other financial instrument, and start laying the groundwork for your estate planning. Compile a list of your accounts and assets to prevent your beneficiaries losing any as unclaimed deposits.

Bank Accounts and Planning Your Estate

When thinking of estate planning, a will typically comes to mind. While a will is important, financial institutions generally do not honor directions in a will without other legal documents generated during probate, so designating a beneficiary for each

account is an absolutely necessary step.

Don’t worry if every account wasn’t initially opened with a beneficiary. Your InTouch member services professionals are here to help. Talk to us today about making sure that all your accounts are up to date with specific, named beneficiaries, and check that part of estate planning off your list.