Getting Your First Credit Card: A Handy Guide

Getting a credit card seems like the simplest thing in the world—and it is. But getting a credit card and using it wisely to start making your financial future solid? That takes a little savvy preparation.

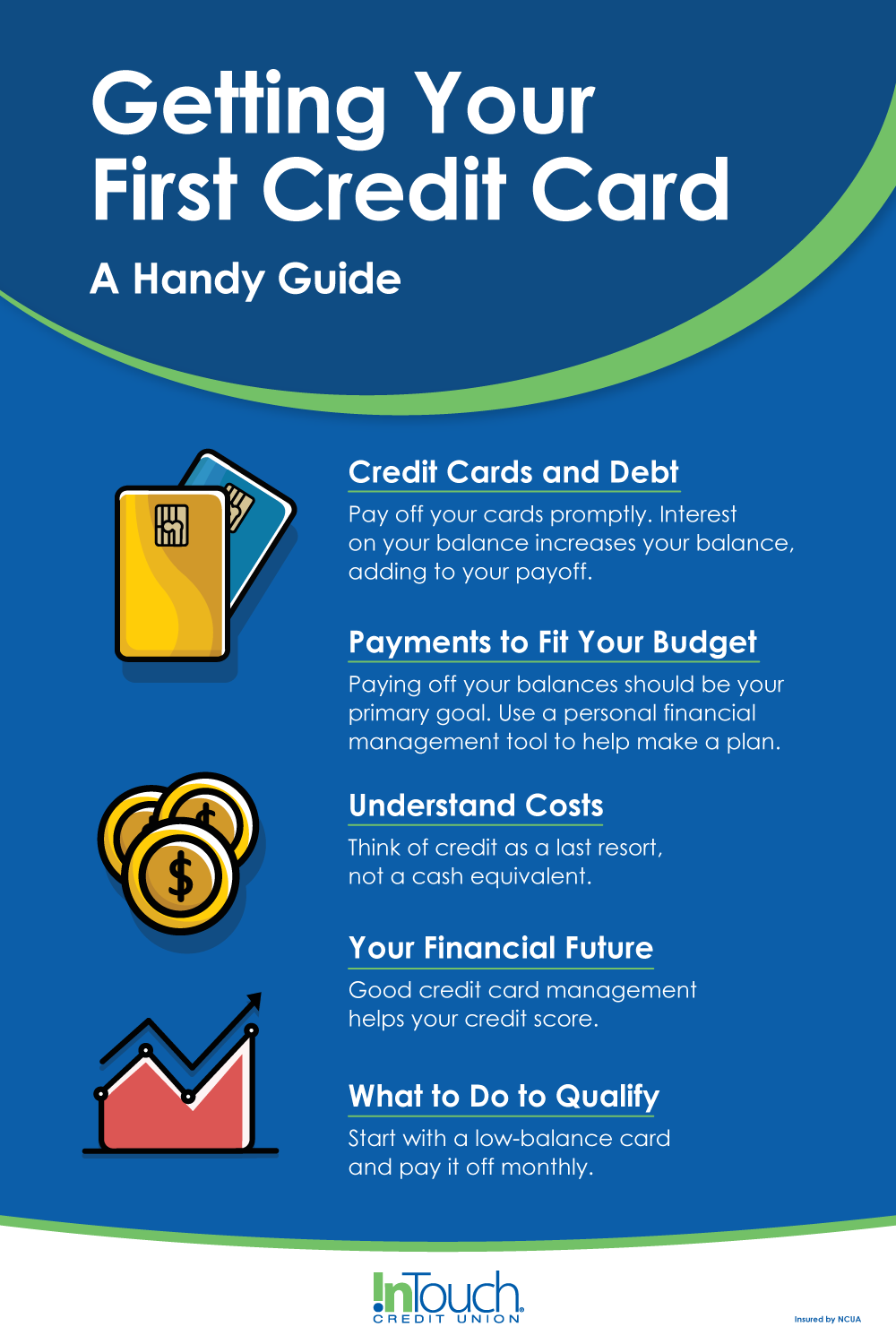

Credit Cards and Debt

Credit cards are the most common form of unsecured debt in the Unites States. Unsecured means that the debt is not backed by some sort of collateral, or tangible asset, that can be taken from the borrower if the debt is not paid. The amount that

you spend is called “the balance,” and the amount that the credit card company charges you to hold your debt (the balance) is called “interest.” Cards vary widely in policy, so make sure that you understand whether the card

you are looking at has a “grace period,” or time between when you spend the money and when you must pay the bill. If there is no grace period, then interest will start accruing as soon as the charge is posted to your credit card account.

If you do not pay off the whole amount of your balance every month, you will begin accruing interest, which will compound, usually on a daily basis. That means it will keep building over time, as the old interest effectively becomes part of the existing

balance, and more interest adds on top of that each day the balance remains. You can see why paying off credit card debt, as quickly as possible, is really important.

Make Sure Credit Card Payments Fit Your Budget

Planning is the key to success with every loan, and a credit card is a loan. You are borrowing against your future income with every purchase or balance transfer, so make sure that you have room in your budget to pay off your credit card balance, plus the interest that accrues as long as you have an outstanding balance. And don’t forget to plan for any fees the card may assess. Credit card companies are required by law to disclose these fees and you will find the fees called out in a box typically seen on the application.

Understand Your Credit Card Costs

If you keep a balance on a credit card (transferred or from purchases), paying off the balance should become your primary goal. Our calculators can help you see what it takes to manage and pay off your credit cards over the long term.

Credit Card Balance Transfer Calculator

As mentioned above, before you take on a credit card, you will want to have a clear picture of your income and spending—in short, your budget. Luckily, InTouch offers a personal financial management tool, Money Management, where you can track your finances by setting a budget and watching your progress by category. It is a powerful tool

that offers you a wide variety of features, but even if you only use it to track your basic budget, you will be a step ahead, knowing where your money goes... and knowing how much you can plan to put toward a goal-oriented purchase, the kind you

might put on a credit card. Remembering that the interest just keeps piling up, you should plan to pay considerably more than the minimum payment to minimize the interest you will pay on the outstanding balance.

What You Do With a Credit Card Affects Your Financial Future

Getting a credit card is often the first thing that young people are told to do, as it “builds your credit history.” This may be true, but how you handle your first credit card determines what kind of credit history you build. Just like paying your rent and electric bill on time, paying off your credit card, or at least making payments on time, makes a real difference to the kind of future you will have, financially.

When you pay bills late, companies generally report it to one or more of the credit bureaus. Credit bureaus are companies that accumulate information about you and your financial behavior. Based on your money-management behavior (debt-to-income ratio and payment history are important in this process), the bureaus assign you a credit score. That score becomes important in every major financial decision you’ll make in your future. When you apply for a mortgage or a car loan, your credit score will be a major factor in everything from whether you get the loan to what your interest rate will be. Even outside of lending, an increasing number of apartment management firms are also using credit scores to make leasing decisions, as well.

What to Do to Qualify for a Credit Card

When you have looked at what you want a credit card for, and your budget shows that you are in a position to pay off your card, it is time to look for a credit card. First-time cardholders will have to show proof of income, at the very least, to begin the qualification process. InTouch Credit Union is a great place to start the process because we are here to help our members make sound financial decisions. It is possible that your first foray into credit will be a low-limit card, for example a card with a $500.00 credit line. This is an opportunity to show you understand credit and can handle the responsibility.

Typically, when you start with a low-limit card, and you pay on time or pay it off each month, you will be rewarded with a credit limit increase. A gradual increase in credit limit also allows you to have a credit card for emergencies, for example, while keeping your debt-to-income ratio low. A first card is unlikely to have a lot of built-in rewards or perks, but don’t let that stop you. Again, the more on-time and in-full payments you make, the better your financial reputation becomes. Over time, that is how you qualify for credit cards with more lavish rewards. In the meantime, you are building a solid financial foundation for your future.

More Resources for Choosing & Managing Credit Cards

Credit cards can be a helpful tool in managing your finances, but they need to be chosen and managed wisely. Here are a few more resources to help you step up your credit card knowledge.

Using a Credit Card to Consolidate Debt

Considering consolidating your debt with a credit card? Learn the pros and cons to see if this approach suits your needs.

Buy Now, Pay Later

or Credit Card?

Do Buy Now, Pay Later payment plans provide a good deal for you, or does it make more sense to stick with a credit card?