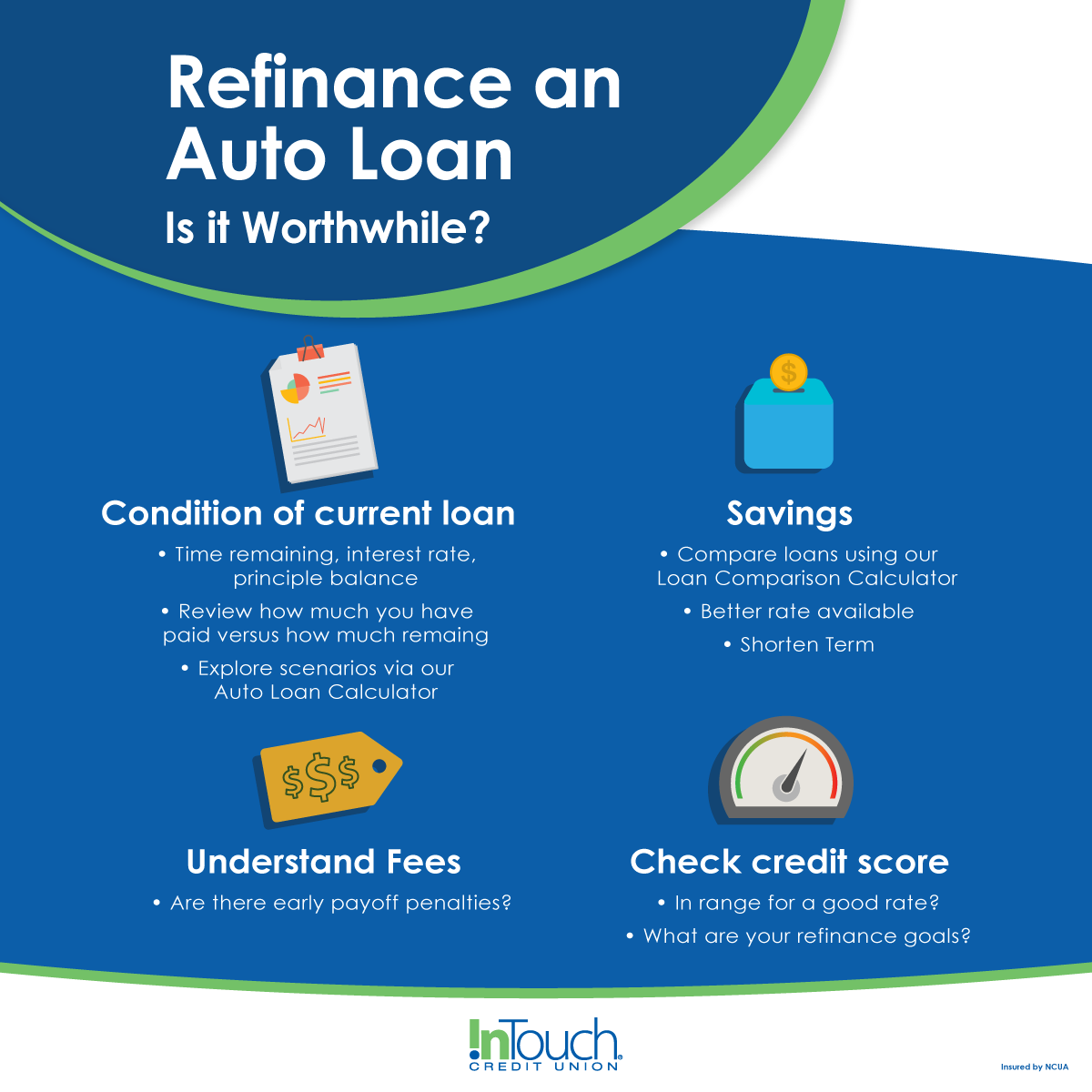

As auto loan terms have gotten longer, the situations when it might be advantageous to consider refinancing your auto loan have increased, too. But what are the most important questions to ask before going forward? The following are some frequently asked questions with answers that you may find helpful as you weigh the pros and cons of refinancing an auto loan.

Q: What is the Condition of My Current Auto Loan?

A: The first question to ask is always, “What is the state of my current loan?” This includes how much time you have left on the loan, what your interest rate is, and how much you owe (principal balance). One of the best things you can do is to check out how much you have paid versus how much you still have left to pay ahead of you.

Q: Has My Credit Score Changed?

A: You should know a fair bit about your current credit situation. Is your credit score where you need it to be to be offered a good rate? You will also want to assess the specific reason you are looking at refinancing. Are you looking for lower rates or lower payments? Be sure that you are clear about your goals so you can aim for the refi loan that best meets your expectations.

Q: Are There Any Early Payoff Fees?

A: Read your current auto loan contract. While auto loans don’t typically carry early payoff penalties, there is no guarantee that yours doesn’t. Double-check before you move forward. You would not want to be surprised at having fees tacked on which would raise the amount of the new loan above what you were planning to draw.

Related Articles

Q: How Much Will I Save?

A: If you decide to refinance, you will want to compare the available loans. When you identify some options, gather the terms, rates, and fees, then enter them in the Auto Loan Refinance Auto Loan Refinance Calculator to see which comes closest to your plan.

In general, you will want to consider refinancing if you find that you can borrow at a significantly lower interest rate. If you took out a long-term loan (72 or more months), it is fairly likely that your interest rate is higher than it otherwise might have been. This could be a good time to lower the interest rate that you are currently paying.

Long-term loans can be swapped for shorter-term auto loans, if your finances allow for it. This is a real opportunity to drop a loan balance that may be keeping you “upside down” through most of the years of owning your vehicle.

Is It Worth Applying for a Refinance Auto Loan?

A: Unlike mortgage loans, auto loans generally do not have application fees, so you can usually apply without a direct financial cost. Check out our Current Rates and use the Auto Loan Calculators to see what term gives you the payment and savings you want and then apply. Even if you eventually decide not to refinance, you will know what is possible.

We most often think of refinancing as a smart option for mortgage loans, but choosing to reassess your current auto loan may create a positive outcome, as well. Asking the right questions and getting a clear picture of your current financial situation sets you on the right path. Check in with an InTouch InTouch Credit Union loan expert Union loan expert today if you would like help evaluating your auto loan refinancing options.