Purchasing a home generally requires a down payment and a mortgage loan that you will pay off at a pre-set rate over the course of 10 to 30 years. The ideal amount for a mortgage down payment is 20%. This is based on the traditional amount that banks have determined cuts their risk significantly enough to make home loans profitable. Furthermore, individuals who already made a substantial investment into a home tend to demonstrate a greater sense of commitment and are less inclined to default on their mortgage.In practical terms, the 20% down payment means that, in most cases, you will not have to take out private mortgage insurance (PMI), which lenders require to protect themselves against defaults. Not being required to buy PMI should save you money in the long run. So, how can you put aside a down payment that will work for both you and your lender?

Know What You Want before You Shop in Real Time

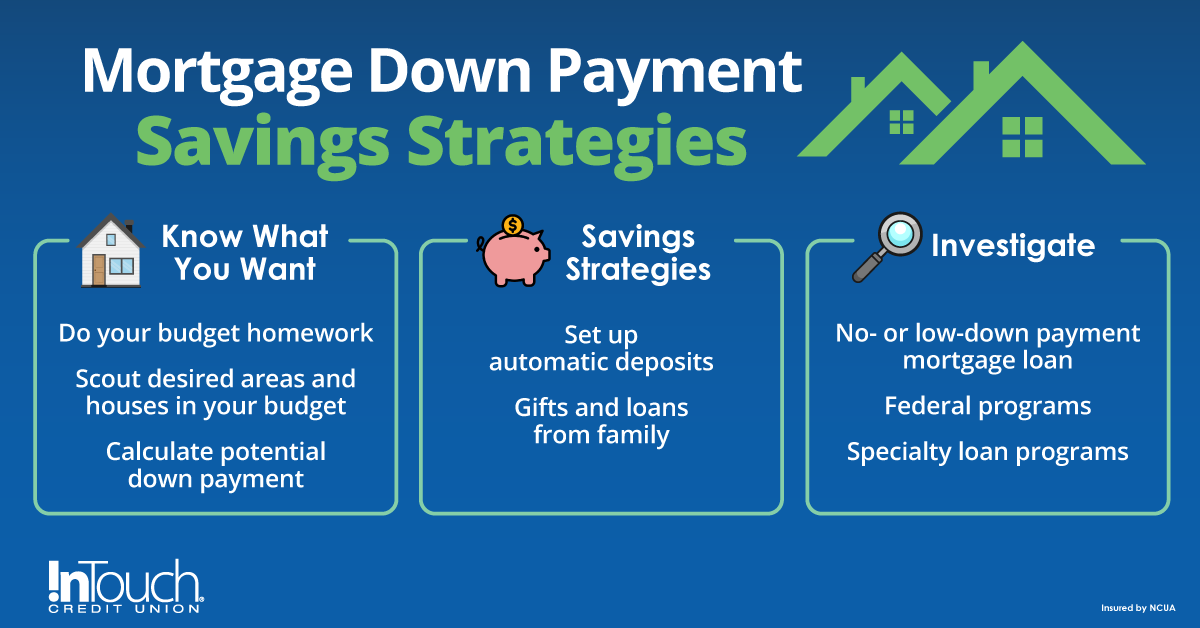

We have become accustomed to the idea of getting pre-approved for auto loans for bargaining power and loan assurance. Now, it is time to apply that same approach to buying a home. What are you looking for? In what area? What is your budget? And what is the down payment?

Mortgage Calculators

Calculate payments at different loan and down payment amounts to find the right fit for you.

Conducting preliminary research before delving into the real estate market can provide insights into which areas are likely to align with your budget, ultimately saving you time during your search. It's also essential to thoroughly assess your budget. While circumstances may not always align perfectly with your financial plan, understanding what you can afford helps establish realistic expectations.

Now comes the difficult part: saving up for the down payment. While it would be great to simply save the 20% of your expected home price ahead by putting a bit aside with each paycheck, that is not a common occurrence when 20% of a $300,000 home is $60,000. Not a lot of homebuyers can set aside that much very quickly. A multi-level strategy must be employed.

Some Ideas to Get You Started

The first strategy for saving is generally the same: set up automatic deposits so your savings is already in place before the rest of your paycheck lands in your checking account. This is an easy and convenient way to assure that the planned amount goes exactly where you want it without your having to take separate actions every time you get paid.

Money Management, our Personal Financial Management (PFM) tool, available through both Mobile and Online Banking, encompasses the tools needed for financial planning and budgeting to help guide you down the path to financial wellness.

You can also find a lender that offers a no- or low-down payment mortgage loan. These loans will require PMI, and, while they can get you into a home, you will have no equity to fall back on. That may be just fine if you plan to live in that specific home for a long time. However, be aware that you almost always have to be in very good credit standing to qualify for these loans.

Alternatively, you could qualify for specialty loan programs from your state. These can be directed at specific geographic areas, or income levels, for example. If you are a first-time homebuyer, state-level mortgage programs may be more broadly available for you. Your ITCU Mortgage Specialist can help you to locate programs that are active in the area where you are looking to buy.

Moreover, the federal government offers some programs through different agencies. If you are or are related to a veteran, you may qualify for a VA housing loan. These loans usually ask that you meet a credit score requirement and pay a one-time VA loan origination fee, but many veterans have used the VA loan program with great success. Another approach is to look at the property you are buying and investigate whether the home qualifies for government loans, such as FHA or USDA. The properties that qualify for these loans are usually in specific geographic locations and may be in historically underserved areas. Consider speaking with one of our loan specialists who can help you navigate these programs since they have specific requirements and may change year to year.

Gifts and loans from family come up as an option on blogs and advice sites fairly frequently, but all parties need to be very clear about the terms of monetary exchanges. Having a serious conversation together is the best way to be certain that everyone sees the money the same way. Keep a written record of the conversation, even if that seems strange for a family situation. The important thing is to see the terms in writing and make copies, so the transfer is less likely to create conflict later. Also, be sure to research if any annual limits on tax-free giving would apply to any gift.

Smart Money Strategies

Preparing for a down payment may require elevating your financial management skills. Explore these insightful articles offering valuable tips on saving and making wiser spending decisions.

Get Professional Help! We Are Here for You

The best strategy to have when you are planning how to afford a home is to work with a team of professionals who want you to succeed. At ITCU, we want our members to live their best financial lives. We provide a whole slate of tools like mortgage calculators and online banking options on our website that you can use. For the more complex parts of life, like buying a home, we are here to help you stay on track. Let’s get started looking for that home!